Boyd Bonds in Strong Shape Following FanDuel Stake Sale

August 2025

Boyd Bonds in Strong Shape Following FanDuel Stake Sale

Boyd Gaming (NYSE: BYD) realized $1.758 billion in revenue last week when it sold its 5% stake in FanDuel to Flutter Entertainment (NYSE: FLUT). By using that cash infusion to pay down debt, the regional casino operator's remaining corporate bonds may become more attractive.

GimmeCredit analyst Kim Noland writes in a recent analysis to clients that Boyd probably makes $1.4 billion after taxes from the FanDuel transaction, which is sufficient to reduce outstanding debt and strengthen the return on capital for shareholders. One of the most devoted purchasers of its own shares in the gaming sector, the Orleans operator has greatly decreased the number of outstanding shares.

"Boydʼs use of FanDuel proceeds to repay debt, including the outstanding balance under its revolver and term loan A, will result an improvement in lease-adjusted leverage, that we now estimate in the low 2x range pro forma the transaction,” observes Noland.

The operator's corporate debt maturing in 2027, which has a yield-to-worst of 5.1%, is rated "outperform" after recent strong price action, she continues, given that Boyd generates an estimated $450 million in cash flow.

Boyd Buffers Strengthen Bonds' Argument

Boyd's solid second-quarter earnings and the stock's 15% year-to-date rise demonstrate how the operator is profiting from its lack of exposure to the Las Vegas Strip.

Based in Las Vegas In its home market, Boyd operates ten gambling establishments: The Orleans, Aliante, California, Cannery, Fremont, Gold Coast, Jokers Wild, Main Street Station, Sam's Town, and Suncoast. In Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi, Missouri, Ohio, and Pennsylvania, it also runs regional casinos.

This combination makes the operator less sensitive to the volatility on the Strip and more sensitive to the still-vibrant locals market in Las Vegas. Similarly, Boyd's main clientele in non-Nevada regions might be less likely to visit gaming establishments in destination markets like Las Vegas, but they still have the resources to travel to casinos that are within driving distance of their homes.

“Boydʼs geographically diversified regional casinos provide mostly drive-to destinations for its core customers in the Las Vegas ‘locals’ and Downtown markets as well as other regional gaming casinos in the Midwest and South,” adds Noland. “The regional locations have fared better with gamblers than some destination resorts like the Las Vegas Strip where gaming win has been impacted by a drop in visitors from Asia, Canada and Mexico.”

Boyd's Irons in the Fire Are Powerful

Although completing such projects will keep capital spending very high over the next few years, Boyd provides creditors and shareholders with additional, longer-term sources of appeal.

“Boyd has several large projects in development, notably the Virginia project at a total cost of $750 million that will require $150-$200 million this year and Cadence Crossing slated at $100 million,” concludes Noland. “Investment projects will keep capex elevated for the next two years.”

While Cadence Crossing will be situated in suburban Las Vegas, allowing the operator to further capitalize on the area's advantageous demographics, the Virginia proposal is for a gambling venue in Norfolk in collaboration with the Pamunkey Indian Tribe.

Related articles

Check out some interesting and relevant articles on casinos.

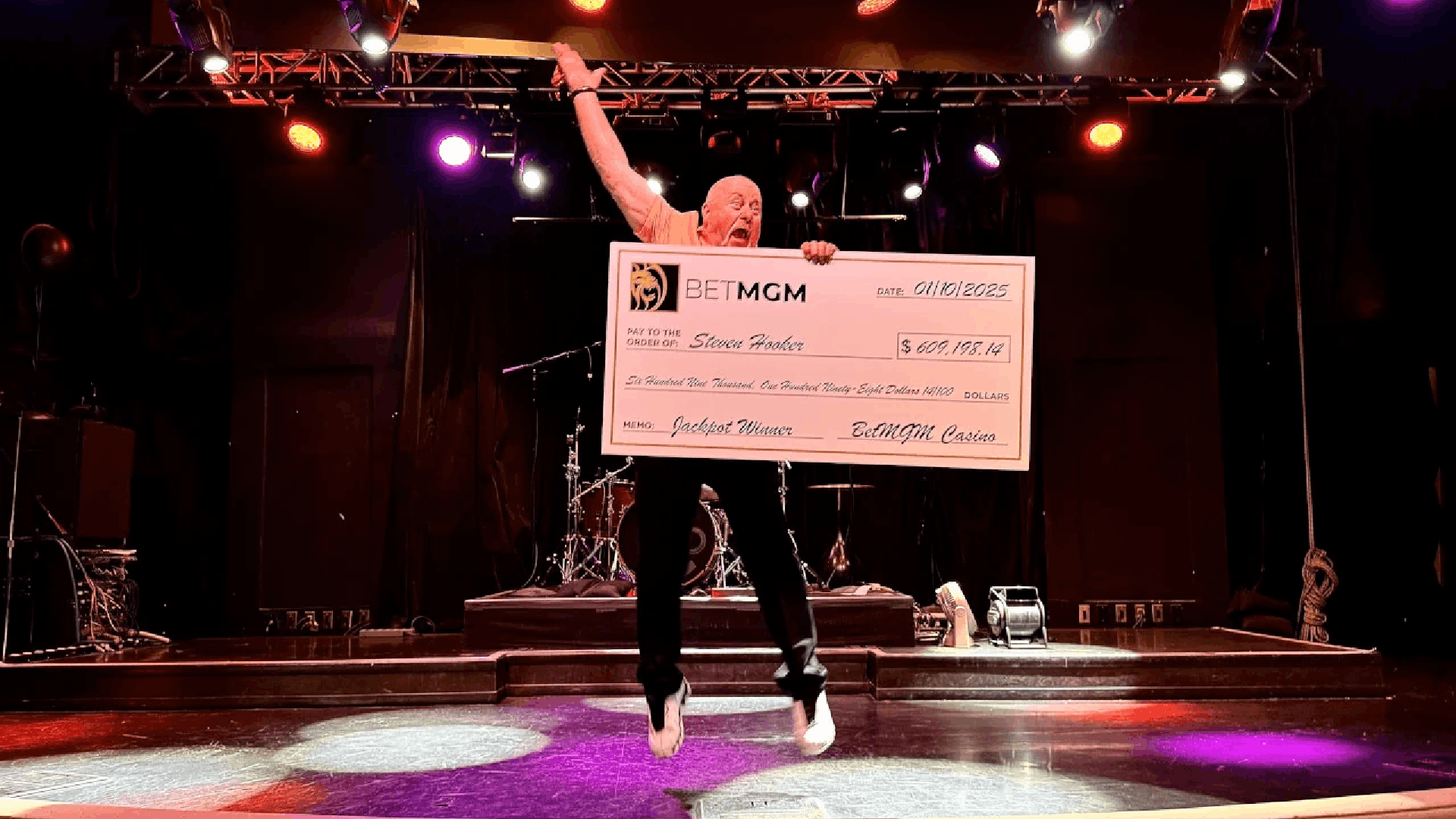

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada