DraftKings Could Buy Back $18 Billion of Stock Over 10 Years, Says Analyst

August 2025

DraftKings Could Buy Back $18 Billion of Stock Over 10 Years, Says Analyst

Over the next ten years, DraftKings (NASDAQ: DKNG) may purchase a significant portion of its shares, perhaps retiring up to $18 billion worth of its ordinary stock.

According to Morningstar analyst Dan Wasiolek, who emphasized the gaming company's financial soundness in a recent research, the majority of that repurchase activity is probably going to take place in the second half of the 10-year estimate. The operator's strong financial standing is demonstrated by DraftKings' potential to reimburse investors at such level.]

"We see DraftKings’ financial health as extremely sound,” observes Wasiolek. “The company remains in a net cash position, ending 2024 with $1.33 billion in cash against $1.26 billion in long-term debt, which is not scheduled to mature until 2028. Further, DraftKings has $500 million available in an untapped revolver.”

Although Boston-based DraftKings has not stated that it intends to buy back $18 billion of its stock over the next ten years, the business is now buying 6.5 million shares in the first half of this year as part of a $1 billion repurchase plan that was disclosed a year ago.

Given DraftKings' current market valuation of $22.69 billion, a $18 billion buyback activity, even spread over ten years, would be enormous and, if it were to occur, would significantly reduce the number of shares that were brought to market through insider selling.

DraftKings Offers Product and Technology Benefits

Despite intense competition, DraftKings and FanDuel have established an apparently unbreakable duopoly in the US online sports betting market. DraftKings is one of the industry leaders due in part to its investments in technology and products.

With football season almost here, the betting giant's product investment, which includes an emphasis on in-game wagering, may act as a short-term stimulant. Wall Street has praised its ability to carry out acquisitions to broaden its tech stack and product portfolio.

"Despite ongoing competition and the threat of heightened regulation, we think DraftKings’ stout technology and product offering produce a brand advantage, the source of its narrow moat,” adds Wasiolek. “DraftKings’ in-house technology platform (acquired in 2020) allows more control into leveraging customer data and launching new products.”

Despite growing competition in the online sports betting market, the Morningstar analyst points out that DraftKings has managed to hold its top revenue position and that the operator is profiting from enhanced in-game and parlay products.

Additionally, DraftKings Has a Branding Advantage

Given the operator's impressive brand recognition, Morningstar rates DraftKings as having a narrow moat, which is preferable to having no moat. Even though DraftKings isn't a name with a large moat, having a competitive moat can eventually increase the shares.

"While the space is rife with competition, we are seeing growing evidence that DraftKings’ critical mass US digital revenue share is proving durable,” said Wasiolek.

He points out that from this year through 2029, DraftKings may have a revenue compound annual growth rate of 21%.

Related articles

Check out some interesting and relevant articles on casinos.

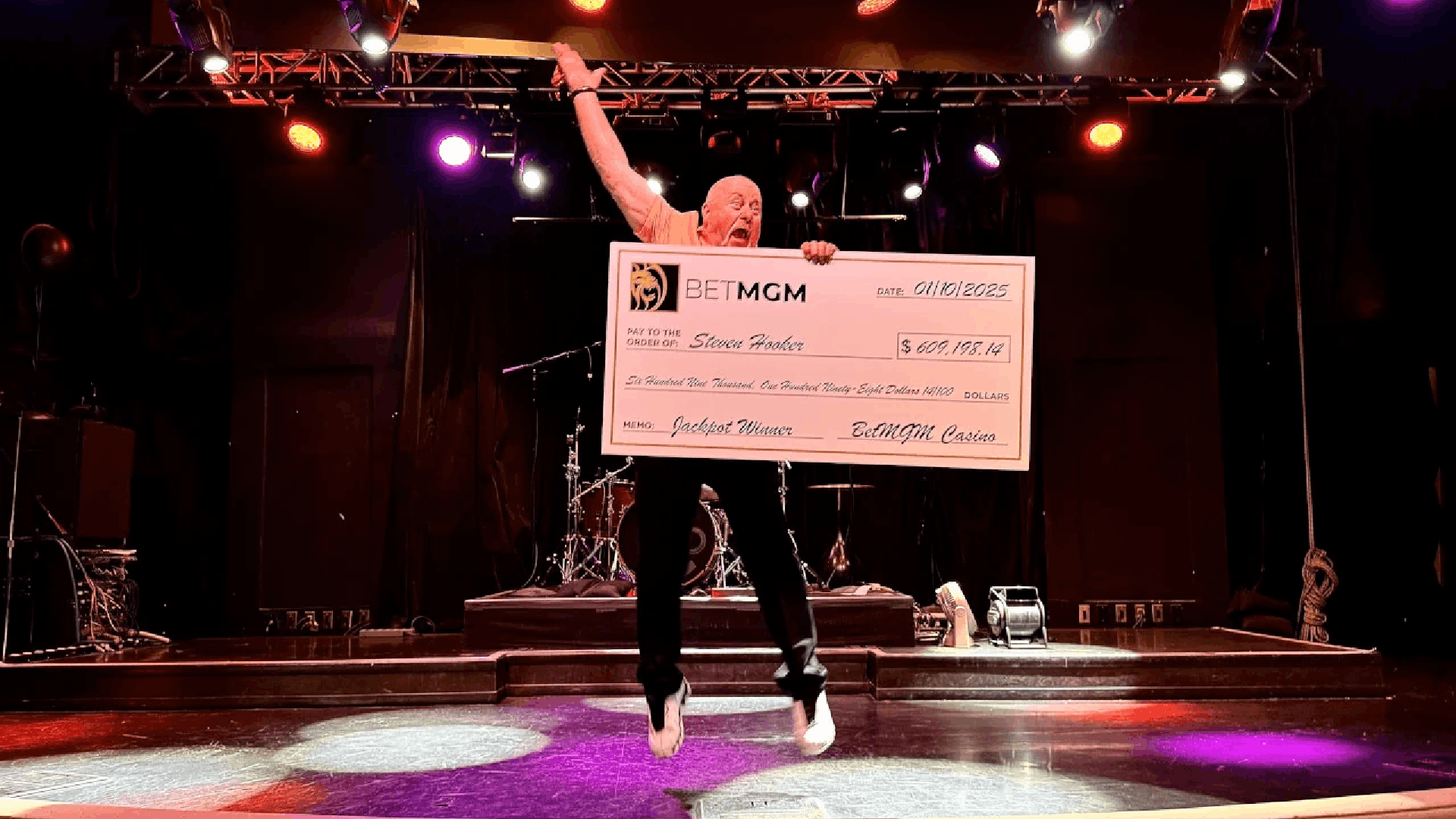

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada