DraftKings Stock Poised for Football Season Bump, Say Analysts

August 2024

DraftKings Stock Poised for Football Season Bump, Say Analysts

Despite being a relatively new asset class, sports betting equities, like DraftKings (NASDAQ: DKNG), exhibit distinct seasonal tendencies. Among them is the beginning of football season, which frequently acts as a trigger.

Even if the argument is simplistic, it makes sense given that American sports betting is centered upon football. DraftKings will be in its fifth season as a stand-alone public firm come football season 2024. According to Dow Jones Market Data, the stock had an average increase of 5% over the previous four from the beginning of the NFL season to the Super Bowl.

Although DraftKings stock has recently been volatile, a 10.69% increase in the last week suggests that investors may already be pricing in the optimism surrounding the football season. A pre-football season purchasing opportunity may be indicated by the recent penalty meted out to the gaming company, according to some analysts.

"With the 2024 NFL season starting on September 5th and DKNG’s share price down 32% from its $50 high in March, this year’s potential return over this seasonally significant window could be meaningful,” wrote Benchmark analyst Mike Hickey in new report to clients.

He maintained his "buy" rating on DraftKings, indicating a 26.4% gain from the closing price of today, with a $44 price objective. The gaming name was deemed a "top idea" by the analyst.

Football and Free Cash Flow May Increase DraftKings Share Price

There might be more to the tale, but two possible drivers for DraftKings are football and a strong free cash flow path.

“DKNGs’ improved outlook, fueled by stronger market win margins in Q3, new user growth, traditional tax mitigation strategies, and valuation contraction ahead of the NFL season, creates an attractive entry point,” adds Hickey.

On the other hand, the court of public opinion might be the largest barrier to the stock's near-term gains. The majority of the recent headlines surrounding DraftKings has been negative, including the cancellation of a plan to tax winning wagers in some high-tax jurisdictions. That attempt was apparently abandoned only because competitor FanDuel refused to follow suit.

Then, it was reported that the gaming company was stopping the Reignmakers fantasy sports game and closing its nonfungible token (NFT) marketplace due to legal concerns. Furthermore, it's been reported that DraftKings paid pennies on the dollar for the sale of Vegas Sports Information Network (VSiN) in contrast to the $70 million the gaming business spent for the radio network in 2021.

“DKNG has turned into a battleground stock,” wrote Needham analyst Bernie McTernan in a recent report to clients.

Experts Are Still Upbeat About DraftKings Stock

Although the current situation with DraftKings may be accurately described as a "battleground," Wall Street is largely positive about the stock.

“Within this market, we believe DKNG has a sustainable customer acquisition strategy that should continue to drive its first- or second-place position in all states,” McTernan noted. “We expect margins to scale with from tech stack ownership, benefits of national vs local marketing and reaching terminal market access penetration.”

DraftKings was listed by Oppenheimer as one of the best equity ideas for August and September in a study that was released earlier on Tuesday. Over the coming year, those thirty-two stocks might do better.

“The company [will be] a critical player in accelerating the shift in U.S. sports betting from about $150B wagered illegally/offshore to licensed domestic operators,” said Oppenheimer of DraftKings.

Related articles

Check out some interesting and relevant articles on casinos.

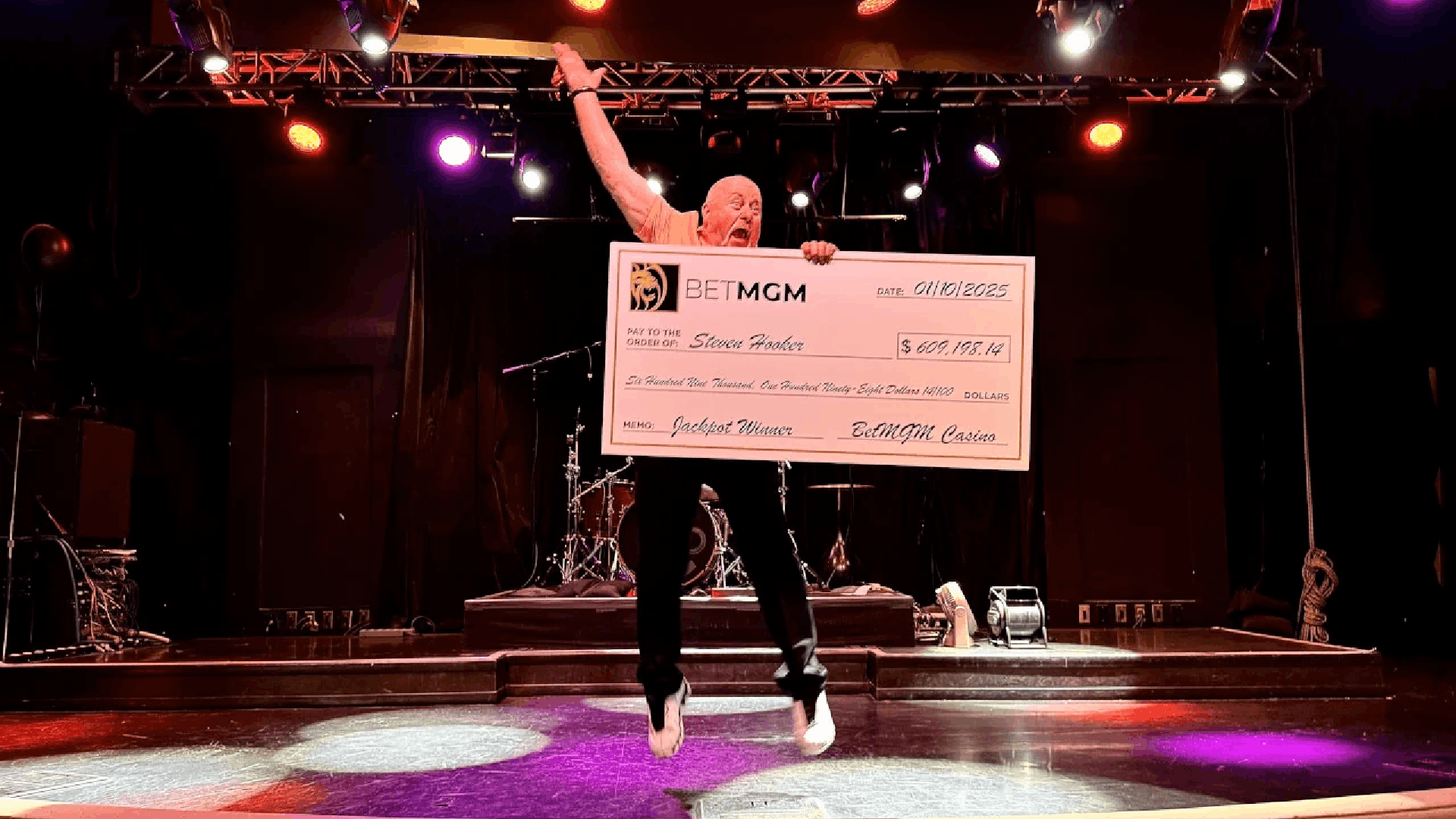

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada