Las Vegas Sands Called Top Casino Stock Idea by Morgan Stanley

July 2023

Las Vegas Sands Called Top Casino Stock Idea by Morgan Stanley

Las Vegas Sands' (NYSE: LVS) stock has increased 26.77% so far this year, highlighting the unexpected congruence with Macau's recovery. The stock, according to some analysts, is poised for further gains.

Prior to the release of the business' second-quarter earnings report on July 19th, Morgan Stanley analyst Stephen Grambling named Sands as the firm's top casino stock pick in a recent report to clients. The five casino resorts operated by Sands' Sands China in Macau play a big role in Wall Street's positive assessment of the stock.

LVS has historically catered to the mass market leader with a market share of about 25% prior to COVID, and it anticipates that share will increase over time as a result of the $2 billion it invested in two Macau properties during the pandemic. With a spotless balance sheet (1x 2024 Net Debt/EBITDA) and $6.5B of cash at the end of 1Q23, LVS's other significant property in Singapore continues to produce positive trends, said Grambling.

The analyst has a $71 price target and rates Sands as "overweight." That suggests an increase of 16.3% from the close on July 14 and is marginally higher than the consensus price prediction of $69.78.

Macau's "Best Way to Play"

One of the six concessionaires in Macau is Sands, and collectively, this group is delivering for investors this year. The Chinese Communist Party (CCP) imposed punitive coronavirus restrictions for three years, but the special administrative region's (SAR) gaming sector is now recovering.

The performance of that collection of casino stocks is not linear. However, Sands has the potential to lead Macau equities if it can control and increase market share among mass and premium mass players at a time when the VIP recovery is still sluggish.

As one of the final consumer recovery stories to emerge from COVID-19, "we see it as the best way to play Macau," said Grambling.

The possibility that Macau's gross gaming revenue (GGR) could eventually reach 2019 levels this year could be a real spark for Sands' second-half catalysts. Last month, that indicator got close to 65% of pre-COVID levels.

Solid Casino Stock Concept for Sands past 2023

Additionally, Marina Bay Sands in Singapore, Sands' only location outside of Macau, continues to perform well, contributing to the stock's second half of 2023, according to Grambling. The calendar is already in July, so it won't be long before analysts and investors start analyzing Sands' 2024 catalysts.

As Grambling notes, these might include the company's dividend, which has been on hold since 2020, the announcement of a share repurchase program, and possibly being selected for one of the three upcoming casino licenses for the New York City region.

Sands used to be the leading dividend payer in the gaming sector, and executives have lauded a preference for restarting share repurchases. But that opinion might shift.

Related articles

Check out some interesting and relevant articles on casinos.

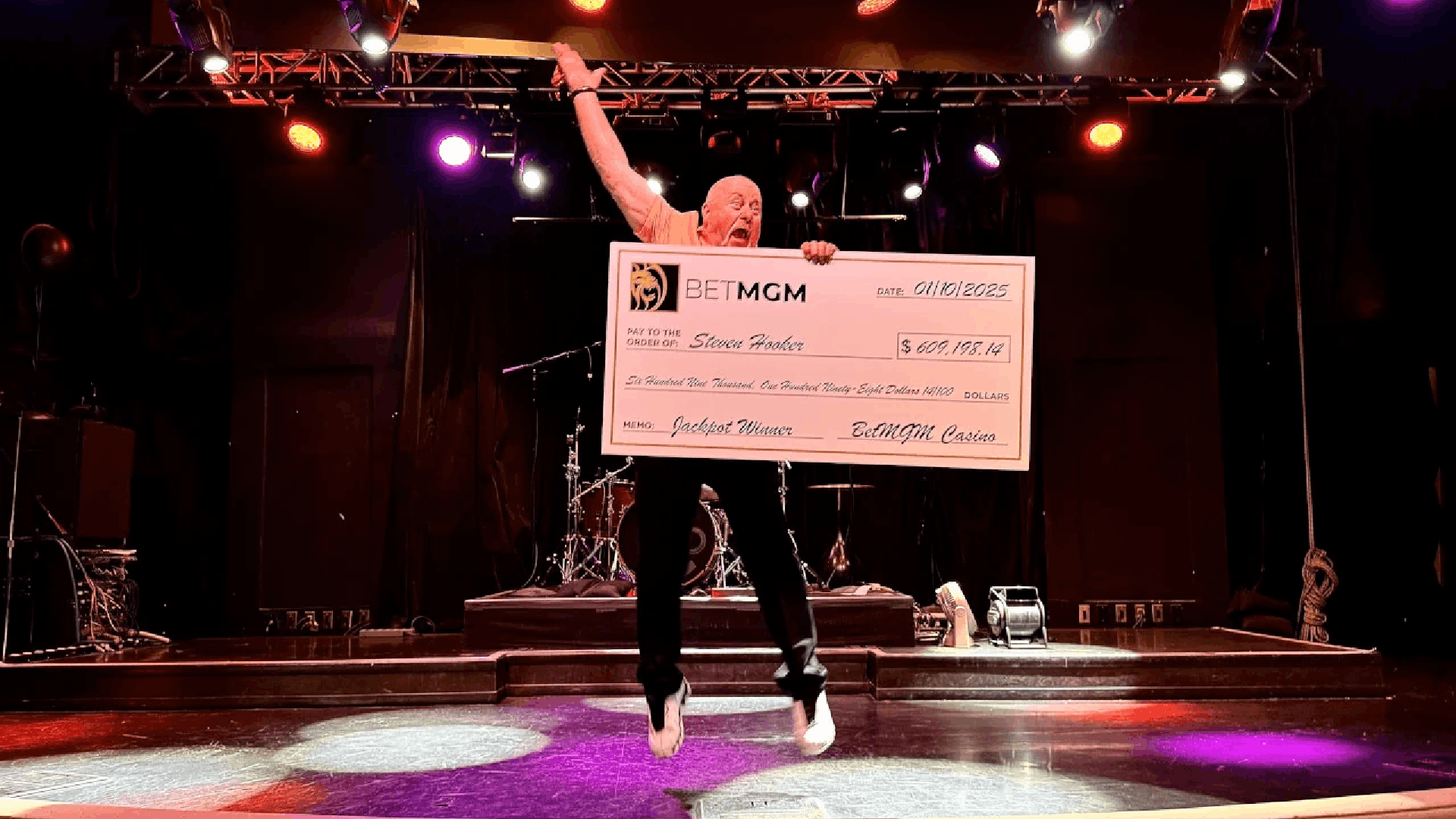

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada