Slot Tax Reporting Threshold Confusion Emerges With ‘One Big Beautiful Bill’

July 2025

Slot Tax Reporting Threshold Confusion Emerges With ‘One Big Beautiful Bill’

Has the slot tax reporting threshold increased from $1,200 to $2,000 as a result of the Republicans' "One Big Beautiful Bill Act" (OBBBA)? Opinions vary.

Section 70433 is one of the numerous tax consequences contained in the federal act that Congress passed and President Donald Trump signed into law earlier this month. The IRS tax code's Section 6041(a), often known as "Application to Reporting on Remuneration for Services," is the subject of the segment.

The reporting minimum is increased from $600 to $2,000 under the OBBBA language. The American Gaming Association (AGA) is interpreting that to include gambling income reported on the W-2G form, according to a story published earlier this week by Casino.org.

An AGA representative said in a statement obtained on Tuesday that the clause "applies to any reporting under section 6041 of the Internal Revenue Code." That part of the code is linked to the slot threshold.

For its explanation, the AGA supplied a link, which is available here.

However, some tax experts have different views. The tax provision only applies to 1099-MISC filers, according to Russ Fox of Clayton Financial and Tax, a well-known tax expert in Las Vegas. Starting the next year, the 1099 filing threshold will rise from $1,400 to $2,000.

According to Fox, the tax reporting requirement for a win from a slot machine or other gambling activity will stay at its existing levels, which are $1,200 for slots, $1,500 for keno, and $600 for table games when the payout is at least 300 times the wager.

Clarification of Taxes

According to Fox, the OBBBA made no changes to the Tax Code's §3402(q), which governs the issuing of a W-2G.

"Thus, beginning in 2026, a W-2G must still be issued at $1,200 for a slot win,” Fox said.

Fox says there is still a chance that the slot barrier will be raised, but he believes the chances are slim.

"Now, it’s possible Congress meant for both limits to increase. Typically, a ‘technical corrections’ bill is proposed. This is usually bipartisan and fixes ‘oops’ items. However, given how polarized Congress is, I have my doubts about such a measure passing this year. And it might be that Congress intended this to be exactly as it is,” Fox continued.

“Finally, it is possible the IRS will interpret this law change to mean the W-2G threshold is increased to $2,000. That would be welcome by almost everyone, but I would not hold my breath waiting for that interpretation,” Fox concluded.

Since 1977, the slot barrier has remained unchanged. Since $1,200 in 1977 is now almost $6,600 due to inflation, the casino industry has long pushed the federal government to raise the barrier. The game stops playing until a slot attendant gives the winner a W-2G form if a player hits a slot reward of at least $1,200.

AGA Remarks

The AGA believes that OBBBA did elevate the slot tax reporting threshold to $2,000, according to Chris Cylke, senior vice president of government relations for the AGA, who spoke to SBC Americas.

“Raising the slot tax reporting threshold to $2,000 and indexing it to inflation is a long-overdue modernization that reduces regulatory burdens and improves the customer experience,” Cylke commented. “It’s a hard-fought win for our industry, and we look forward to working on regulatory implementation.”

Related articles

Check out some interesting and relevant articles on casinos.

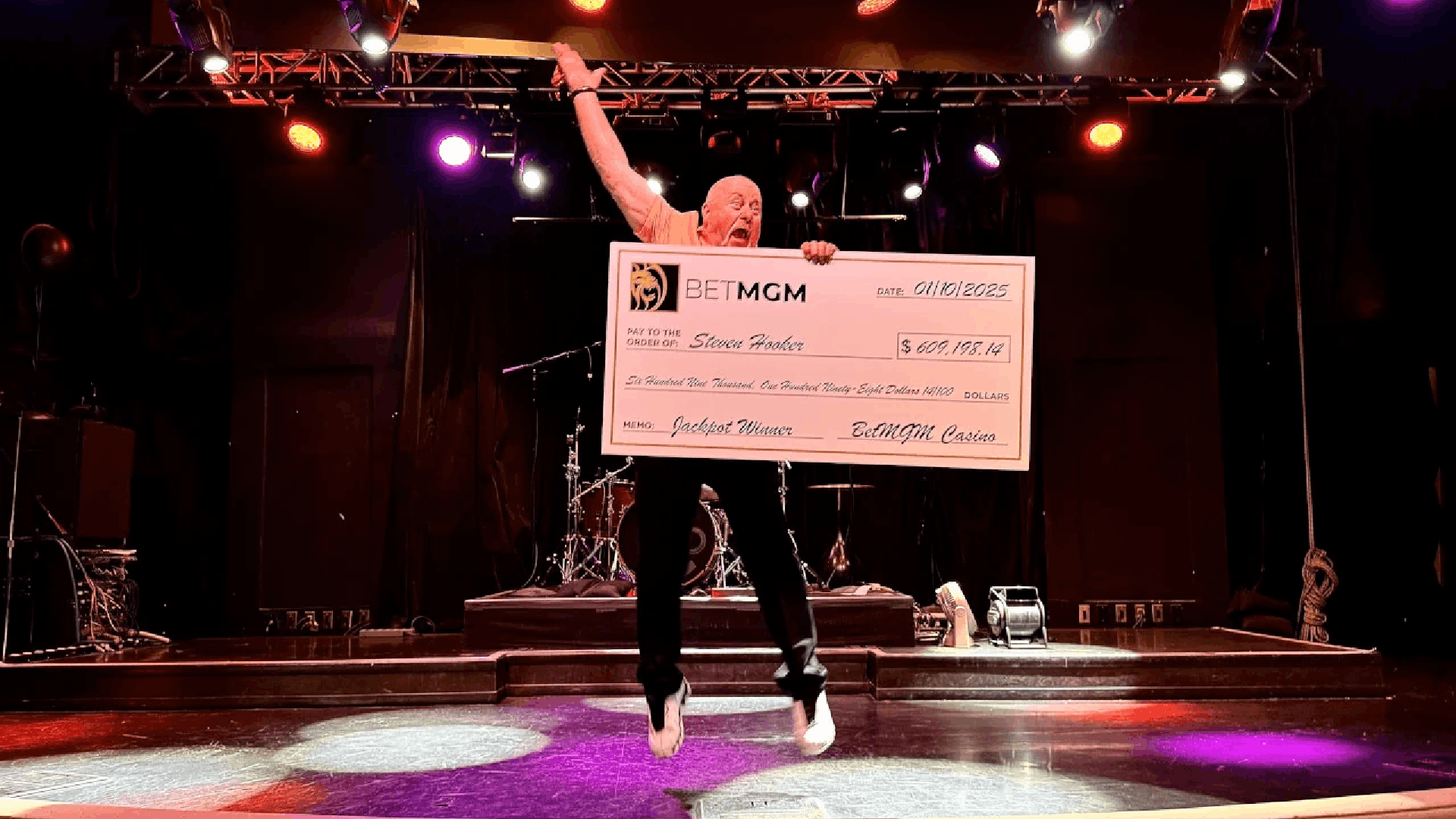

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada