Caesars, DraftKings Seen as Winners as Maine Approves iGaming

January 2026

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Janet Mills (D) said she’ll sign a previously passed bill into law.

The law allows Native American tribes to collaborate with commercial operators by giving them exclusive control over that type of gambling in the New England state. According to some market watchers, the arrival of iGaming in Maine could be advantageous for Caesars Entertainment (NASDAQ: CZR) and DraftKings (NASDAQ: DKNG).

"Several of the notable gaming operators were opposed to the bill but will now be competing for the final two licenses, with our assumption that DraftKings and Caesars will secure two spots; we believe DKNG and CZR will have a clear advantage with their existing databases,” wrote Citizens Equity Research analyst Jordan Bender in a Friday note to clients.

He notes that with market shares of 85% and 15%, respectively, DraftKings and Caesars effectively control a duopoly in Maine sports betting.

The Potential Failure of the Maine iGaming Market

Based on Bender's assessment that Caesars and DraftKings are almost certain to obtain two of Maine's four iGaming licenses, a fierce battle may develop for the remaining two licenses.

If the commercial land-based casino operators in the state, who were against the internet casino measure, alter their minds, it will be intriguing to watch. These businesses are Penn Entertainment (NASDAQ: PENN), which has a rapidly expanding iGaming division, and Churchill Down (NASDAQ: CHDN).

In Bender's hypothetical scenario, Caesars, DraftKings, and FanDuel would possess three of the Maine iGaming licenses, while BetMGM, Fanatics, Penn, or an unnamed candidate would receive the fourth permission. Despite its tiny population, it is certain that Maine's accommodating taxation will make it a desirable market for potential iGaming companies.

“Remarkably, the tax rate is only 18% on gaming revenue, fairly low in a time when gaming tax rates across the industry continue to increase,” observes Bender. “We expect DraftKings to generate the most earnings before interest, taxes, depreciation, and amortization (EBITDA) and be the most impactful for forward-looking EBITDA estimates.”

Maine Offers a Surprise in iGaming

On at least two levels, Mills' choice to approve the aforementioned bill is astounding. Initially, the gambling industry was in agreement that no new states would authorize sports betting or iGaming this year. Second, surveys showed that a sizable majority of the state's voters are against the legalization of online casinos.

However, even if Maine gave the gambling industry a welcome surprise, other states won't necessarily quickly follow suit this year.

“We are not in the camp that believes one state legalizing iGaming will act as a domino effect into other states given complex state-by-state politics,” concludes Bender. “That said, bills now being introduced (e.g., Virginia) also show opposition to iGaming bills, but Maine has shown that state politics can override popular opinion. Said another way, Maine should be viewed as a positive data point for states looking to legalize iGaming in the coming years.”

Related articles

Check out some interesting and relevant articles on casinos.

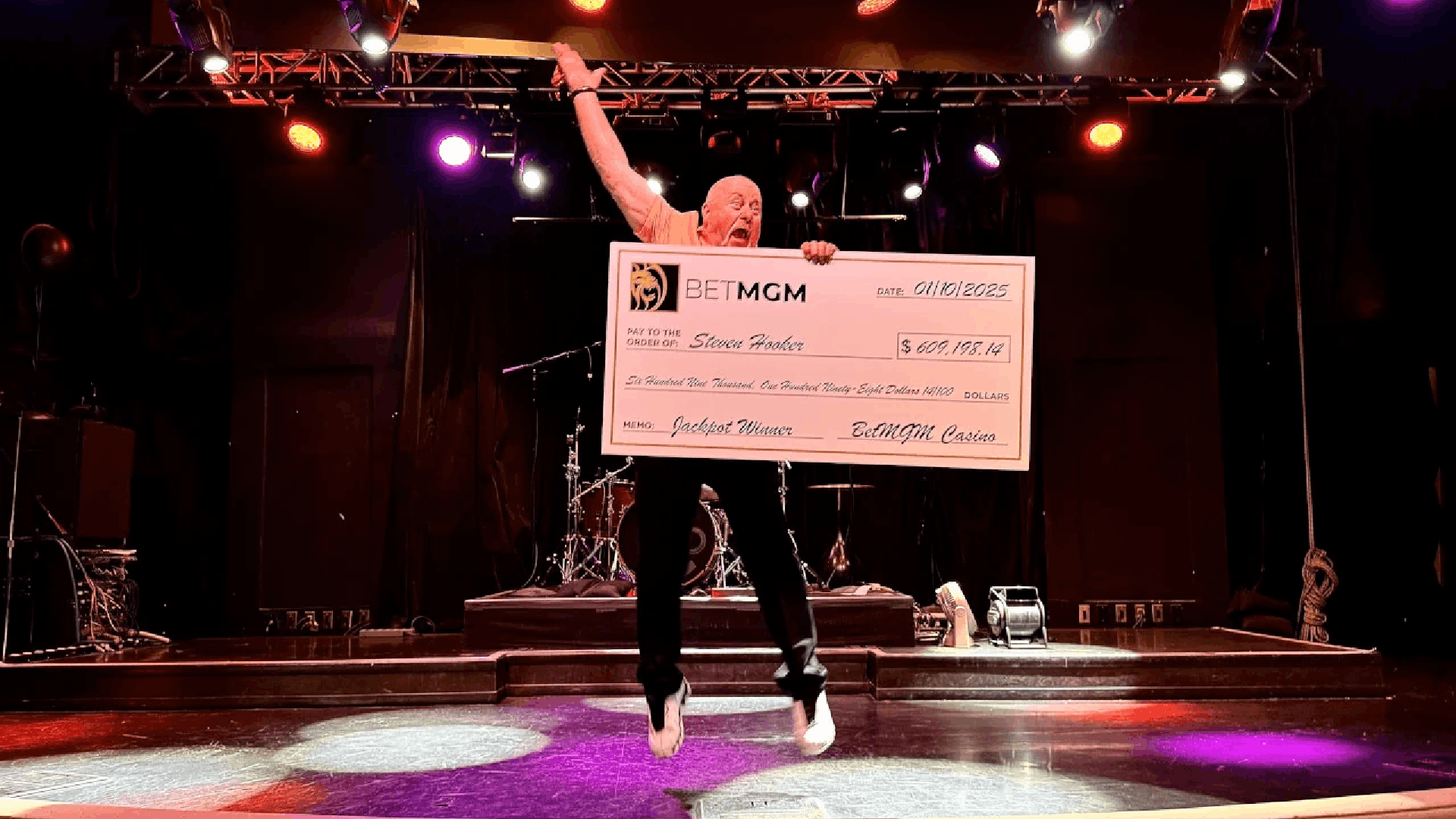

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

Fox Not Looking to Get Into Sports Betting, Says CFO Tomsic

Despite being one of the most well-known brands in US sports streaming and broadcasting, Fox Corpora..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada