Fox Not Looking to Get Into Sports Betting, Says CFO Tomsic

December 2025

Fox Not Looking to Get Into Sports Betting, Says CFO Tomsic

Despite being one of the most well-known brands in US sports streaming and broadcasting, Fox Corporation (NASDAQ: FOX) has no plans to use its position to enter the sports betting market again.

CFO Steven Tomsic stated at UBS' 2025 Global Media and Communications Conference on Monday that the media giant is not considering a comeback to sports betting. News Corp (NASDAQ: NWSA) and Flutter Entertainment (NYSE: FLUT) dissolved FOX Bet in July 2023. The latter acquired the Stars Group in 2020.

Fox became a stakeholder in the gaming company through Flutter's acquisition of Star, and it currently controls 2.5 percent of the parent company of FanDuel. At the UBS conference, Tomsic stated that the shareholding has a $900 million value.

It wasn't shocking that FOX Bet failed in 2023. Flutter has made no secret of giving FanDuel priority over FOX Bet for years before. The FOX Bet brand is still owned by the broadcasting corporation.

Fox Content Will Invest in Sports Betting

Rumors circulated shortly after FOX Bet's demise that the broadcast behemoth was seeking to revive the company and was in discussions with other gambling businesses about it. Nothing worked out. By 2025, it seems that Fox is happy to be an investment in sports betting.

"We have enormous respect for what Flutter brings to the table in terms of sports betting prowess,” said Tomsic at the UBS conference. “We’re happy as a sports business to bring the sports broadcasting element to it.”

It might be a good idea for Fox to avoid sports betting. Nearly all newcomers have found it tough to challenge the DraftKings/FanDuel duopoly in the very competitive US market. There are numerous operators in the US sports betting graveyard, some of which have well-known names, that gave up because they were unable to get a sufficient portion of the market.

Since these initiatives are expensive, Fox could be better off saving money to strengthen its balance sheet and expand its other profitable ventures. In a same vein, Tomsic stated that the business is not currently actively seeking mergers and acquisitions.

Fox Continues to Be Known for Sports Betting

Although Fox isn't directly involved in either the consumer-facing or business-to-business aspects of the sports betting market, it is exposed to the latter through its option to purchase 18.6% of FanDuel. Until 2030, the media organization may use those rights.

FanDuel was originally valued by Fox at $35 billion, thus 18.6% is worth $6.5 billion. But according to the July 2025 deal, when Flutter bought an unclaimed 5% stake in FanDuel from Boyd Gaming, the sportsbook was valued at $31 billion at the time, which was $4 billion less than Fox had estimated.

Nevertheless, Fox is positioned to profit from the expansion of sports betting without having to get involved in the business thanks to the rights to purchase 18.6% of FanDuel.

Related articles

Check out some interesting and relevant articles on casinos.

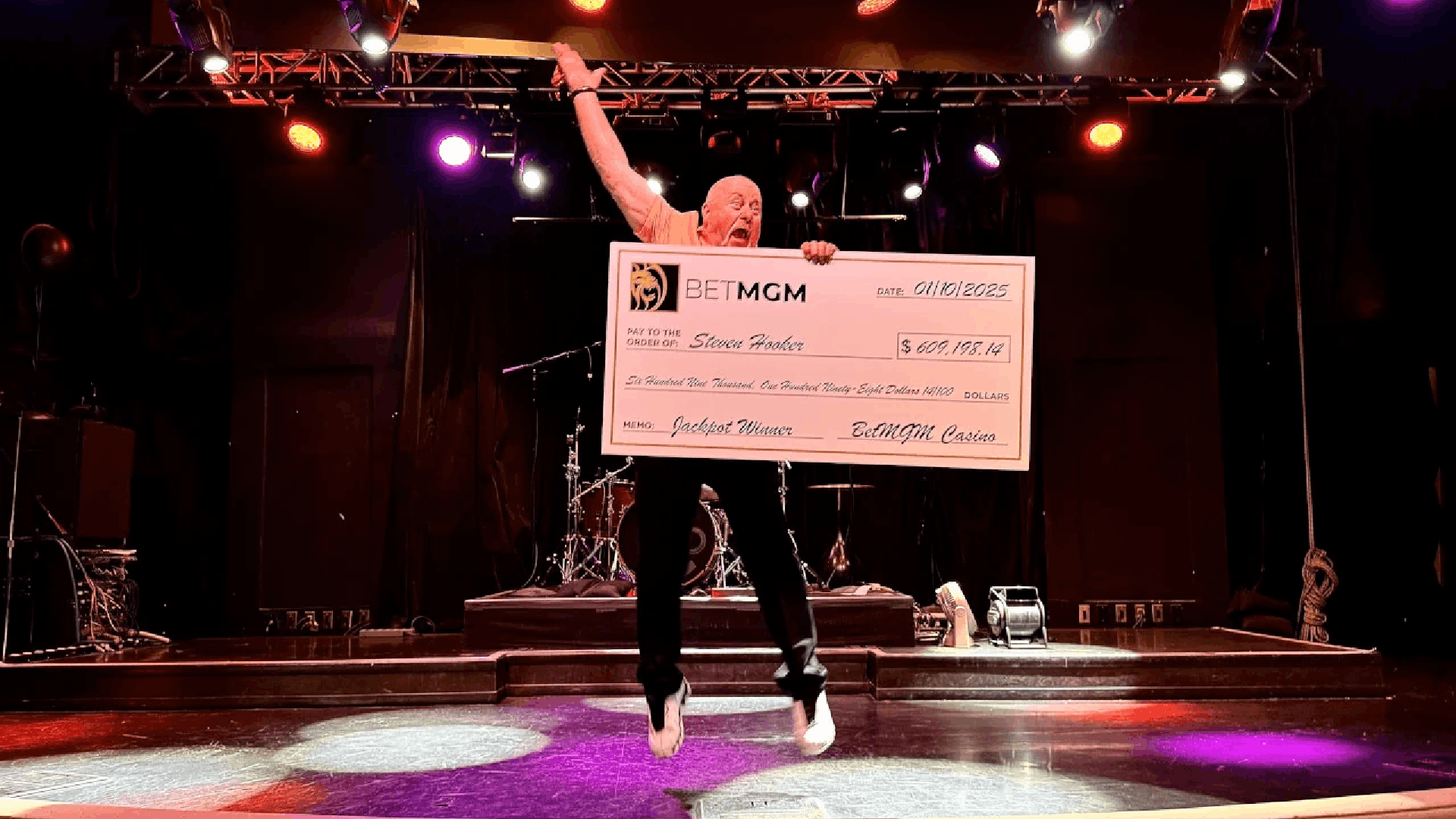

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada