Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

December 2025

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget, which Mayor Brandon Johnson (D) stated he would neither approve nor reject. The charge may force operations out of the city and drive bettors to unlicensed bookies, according to a trade association.

In an effort to raise at least $26 million, Johnson's proposal proposes a 10.25% tax on operator revenue produced in the third-largest US city. Operators' tax obligations on receipts earned in Chicago would increase to 32.25% if the new levy is implemented.

In Illinois, which has some of the highest sports wagering taxes in the nation, it would make things worse for gaming enterprises. Illinois levies a 25-cent fee on an operator's first 20 million booked bets and a 50-cent fee after that, according to a recently approved law that took effect in July. A city-specific levy, according to the Sports Betting Alliance (SBA), will push bettors to underground bookmakers.

"The new Chicago tax on sports wagering will drive more sports fans to illegal, predatory websites and bookies that are thriving online without any oversight or consumer protections, while avoiding tax obligations entirely,” according to the trade group. “Further penalizing players in the City of Chicago pushes more sports fans to unregulated, illegal alternatives and has serious implications for the sustainability of the legal market.”

A new $6.8 million tax on video gaming terminals (VGTs) is included in the city's new budget.

Other Issues Are Raised by the Chicago Sports Betting Tax

Some gambling companies may decide to stop providing sports betting in Chicago as a result of the new sports wagering tax, which is causing additional licensing issues.

These concerns stem from complaints that Johnson's tax proposal lacks a sufficient regulatory structure and that operators might not have enough time to comply given its January 1 implementation date. Then there is the concern that bettors will be forced to increase their wage levels if the city's sports betting levy moves in the right direction.

“The city’s new tax has raised concerns of city leaders and industry experts who argue that raising the cost to bet will have unintended consequences by pushing more consumers to place higher bets or pushing more people to seek out illegal alternative,” adds the SBA.

Recent data shows that the aforementioned state tax increases, which went into effect in July, reduced the number of bets but increased state income. This suggests that bettors are actually raising the size of their wagers while decreasing their wagers.

The Reasons Chicago Needs Funds

Public pension debt is a major contributor to Chicago's financial difficulties, and the new Bally's casino is also expected to address this issue. According to Illinois Policy, Chicago's $53 billion in unfunded public pension liabilities actually surpass the corresponding totals of 44 states.

Furloughs, increased healthcare costs, and pay freezes for city employees are not included in the Johnson budget, which also includes the sports betting and VGT taxes. In fact, it demands raises.

Related articles

Check out some interesting and relevant articles on casinos.

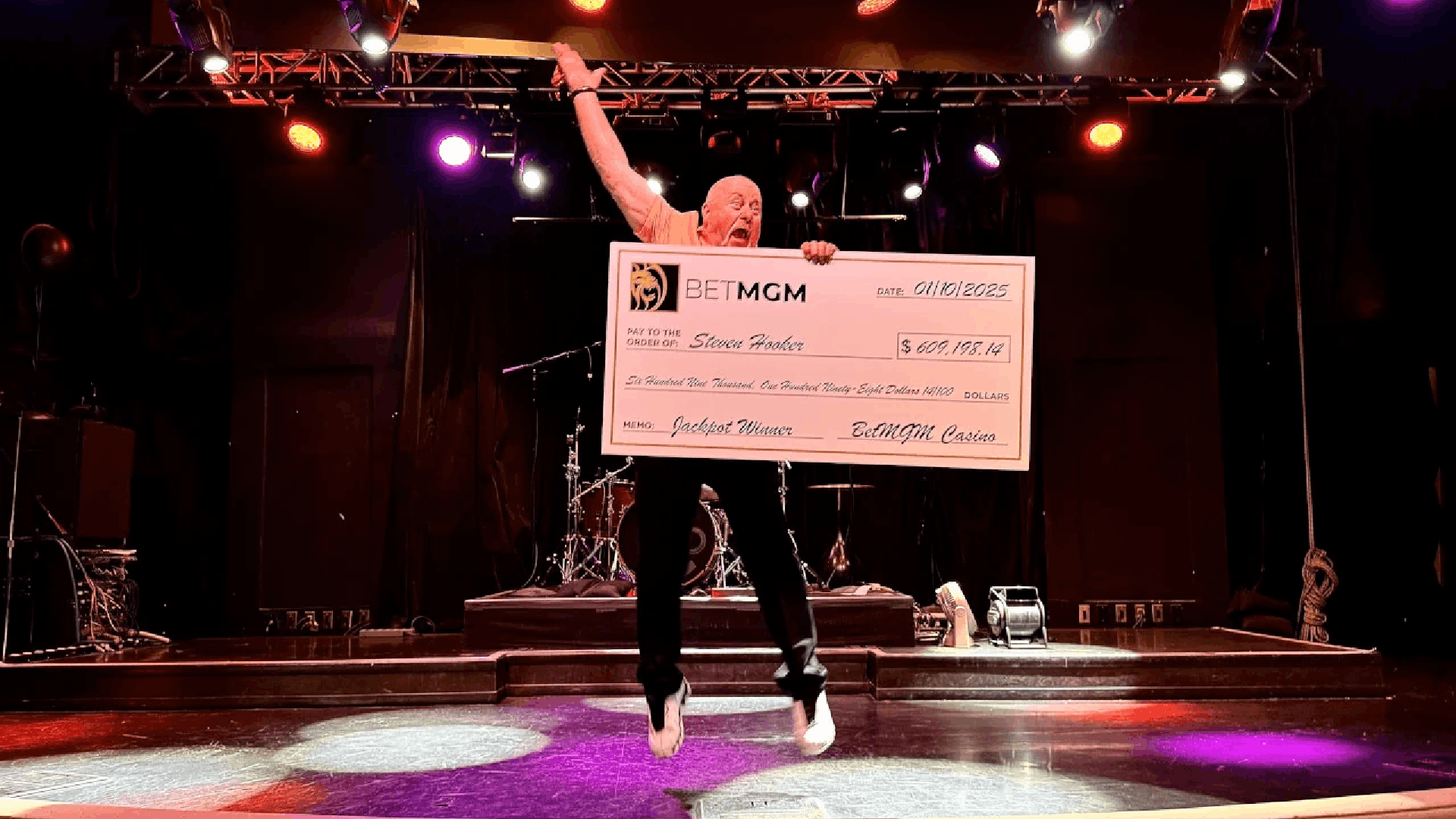

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Fox Not Looking to Get Into Sports Betting, Says CFO Tomsic

Despite being one of the most well-known brands in US sports streaming and broadcasting, Fox Corpora..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada