Flutter Buying Boyd FanDuel Stake Valuing Sportsbook at $31B

July 2025

Flutter Buying Boyd FanDuel Stake Valuing Sportsbook at $31B

Following the announcement that the regional casino was selling its 5% stake in FanDuel to Flutter Entertainment (NYSE: FLUT) for $1.755 billion, Boyd Gaming's (NYSE: BYD) stock closed up 1.50% and continued to rise during Thursday's after-hours session.

FanDuel, the leading online sportsbook operator in the United States and a well-known brand in the iGaming sector, will now be fully owned by Flutter. The two gambling businesses have been working together since August 2018, when they came to a strategic arrangement that allowed Flutter to use FanDuel to enter the US sports betting industry. Boyd acquired a share of FanDuel as part of that agreement.

According to Flutter, the agreement, which is anticipated to finalize this quarter, indicates that FanDuel is valued at $31 billion and will result in $65 million in yearly cost reductions through "significantly reduced market access costs in the states where FanDuel's market access is provided by Boyd." Boyd Sports is its sports betting website in Nevada; however, in other states where it owns land-based casinos and sports betting licenses, it collaborates with FanDuel. Boyd will assume management of its retail sportsbooks outside of Nevada in mid-2026.

"Under terms of the revised market-access agreements with FanDuel, the Company now expects its Online segment will generate $50 million to $55 million in operating income and adjusted earnings before interest, taxes, depreciation, amortization, and restructuring or rent costs (EBITDAR) for the full year 2025, and approximately $30 million in 2026,” according to a statement issued by Boyd.

The Las Vegas-based business stated that it plans to pay down its debt using the money from the deal. The partnership between Boyd and Flutter has been prolonged until 2038.

FanDuel Valuation Outperforms Other Stocks for Sports Betting

Flutter is already by far the biggest publicly traded gaming firm in the world, with a market valuation of $50.48 billion as of today's close.

The suggested FanDuel valuation of $31 billion, however, suggests that Flutter shares might be cheap. If nothing else, it demonstrates that FanDuel is worth a lot more than its competitors. For instance, two pure-play iGaming/sports betting companies, DraftKings (NASDAQ: DKNG) and Rush Street Interactive (NYSE: RSI), have a combined market value of over $25 billion.

There were speculations four years ago that Flutter would split out FanDuel in order to generate profits for investors. Although the company made no mention of it, it's possible that some investors will want to reconsider the matter of separating the US business from Flutter given the price tag Boyd is commanding in the aforementioned transaction.

In order to finance the acquisition of the FanDuel interest from Boyd, Flutter did reveal that they had reached an arrangement with a few creditors for a $1.75 billion senior secured first lien term loan. "With two additional six-month extension options," that credit facility matures 12 months after it is first utilized.

Fox might have overestimated FanDuel's worth

The acquisition clearly benefits Stake Boyd, which gains funds to strengthen its balance sheet while selling for a price that is around 25% of its market worth. Long-term stability is also gained in the FanDuel relationship, although the situation could have a "loser."

Fox Corporation (NASDAQ: FOX), a media behemoth with an option to purchase 18.6% of FanDuel, valued the company at $35 billion earlier this year, which translates to $6.5 billion for 18.6%. Flutter said in the announcement that the sportsbook is valued $31 billion, of which $5.76 billion is 18.6%.

In an attempt to perhaps exercise its option in the future, the media firm is navigating the licensing procedure in the jurisdictions where FanDuel places bets. Additionally, Fox has interest in Flutter, which is growing in value given that the gaming company's stock has increased 46.66% in the last 12 months.

Related articles

Check out some interesting and relevant articles on casinos.

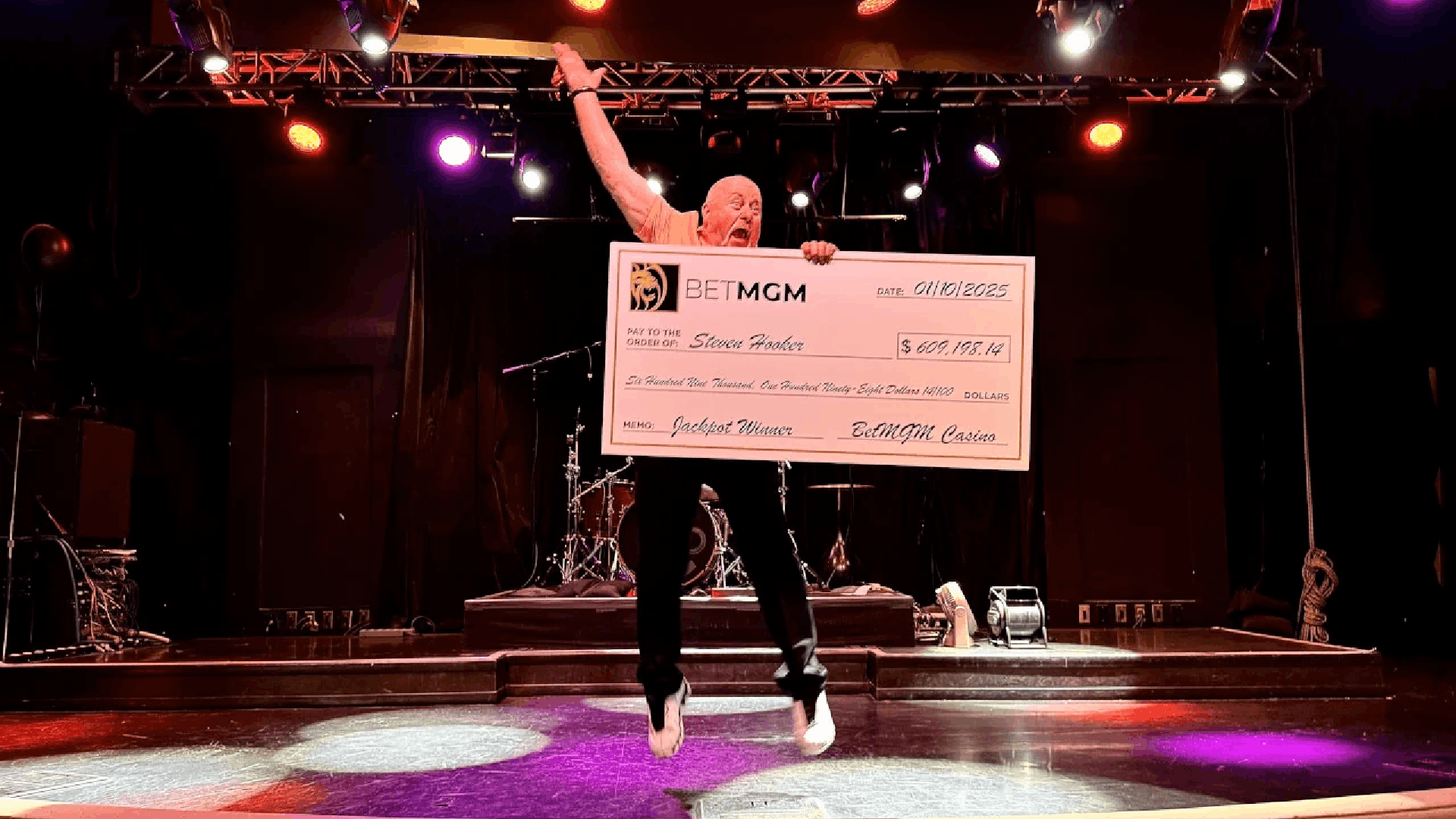

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada