Gaming Operators Suffer in $31M Hack of Cryptocurrency Payments Platform

July 2023

Gaming Operators Suffer in $31M Hack of Cryptocurrency Payments Platform

Alphapo, a platform for cryptocurrency payments, has been the target of a significant hack, dealing yet another blow to the cryptocurrency community. Digital assets worth millions of dollars were stolen as a result of the attack, which may also have had an effect on the operations of online gambling companies like Bovada and Ignition.

HypeDrop, an online store where customers can buy "mystery" boxes, was one of the first to alert people that something was wrong. The extent of the hack turned out to be much more serious than initially thought as the details emerged later. There are reports that the theft may have been as high as $100 million, though the majority of indications place the total at around $31 million.

Investigating the Hack.

When they detected suspicious activity on the platform early on July 22, Alphapo staff members were informed of the security breach. When the company's cybersecurity team started looking into the incident, they found that hackers had possibly used a wallet address leak to gain access to the company's hot wallets, a type of internet-connected repository.

The hackers were able to breach several lines of defense and used the compromised address or addresses to withdraw sizeable amounts of different cryptocurrencies. Initial reports indicate that bitcoin (BTC), ethereum (ETH), and tron (TRX) are among the stolen assets.

Alphapo suffered serious losses in terms of money and reputation as a result of the cyberattack. To stop further unauthorized access and contain the damage, the platform's services were momentarily suspended.

In response to the attack, HypeDrop also stopped accepting crypto deposits and announced the decision on its social media accounts. There is no evidence that the online gaming operators Alphapo supports Bovada, Ignition, or any other have publicly addressed the hack or taken any action to limit the potential harm.

As of the time of publication, a comment request had gone unanswered.

Conic Finance, a decentralized financial protocol, was recently attacked by hackers along with another cryptocurrency platform. It experienced two breaches, one of which resulted in the theft of $300K and the loss of $3.26 million in ETH.

Investors and users are now concerned about the security of their assets on cryptocurrency exchanges due to the incidents. After significant crypto scandals like the FTX collapse, calls for more regulatory oversight and accountability in the sector have become much louder.

Focus on Crypto for the Wrong Reasons

The Alphapo hack has wider repercussions for the entire cryptocurrency market. Although blockchain technology promises high levels of security, incidents like this and criminals' use of cryptocurrencies expose weaknesses that bad actors can exploit. Strong cybersecurity measures are even more necessary as cryptocurrencies become more widely used.

The incident is likely to be closely examined by regulators around the world, who may then demand stricter security requirements and regulatory oversight for cryptocurrency platforms. The operations and cost structures of these platforms may be impacted by the increased compliance requirements that may result from such scrutiny.

Some UK lawmakers have even tried to give the UK Gambling Commission control of the cryptocurrency industry because they think it should be governed similarly to gambling. That notion hit a roadblock.

It will be essential for the development and acceptance of the industry to strike a balance between security and preserving the decentralized nature of cryptocurrencies. Global regulations and knowledge of cryptocurrency are required for this to happen.

Related articles

Check out some interesting and relevant articles on casinos.

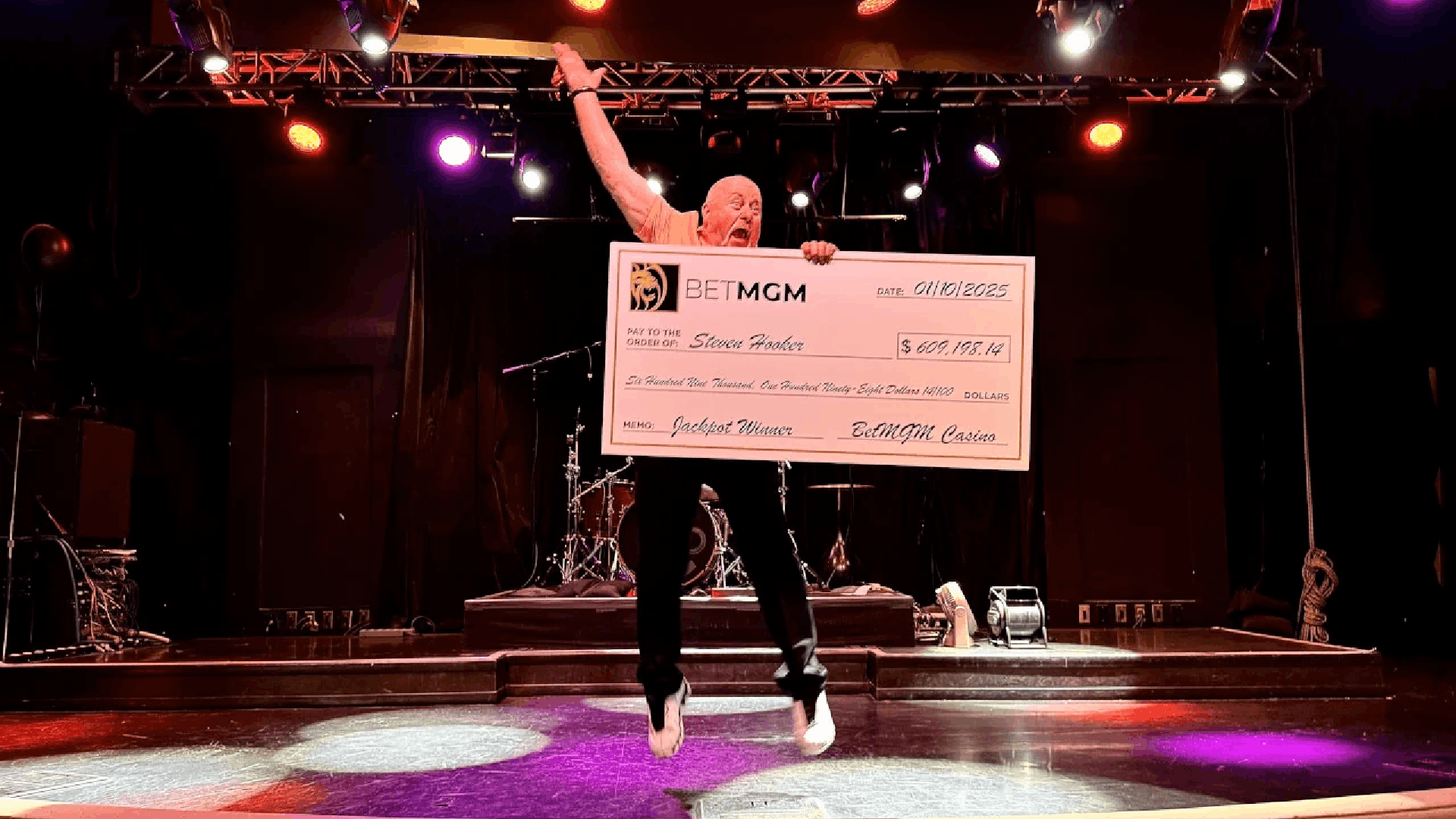

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada