Icahn Reveals Caesars Stake Is 2.44 Million Shares

August 2024

Icahn Reveals Caesars Stake Is 2.44 Million Shares

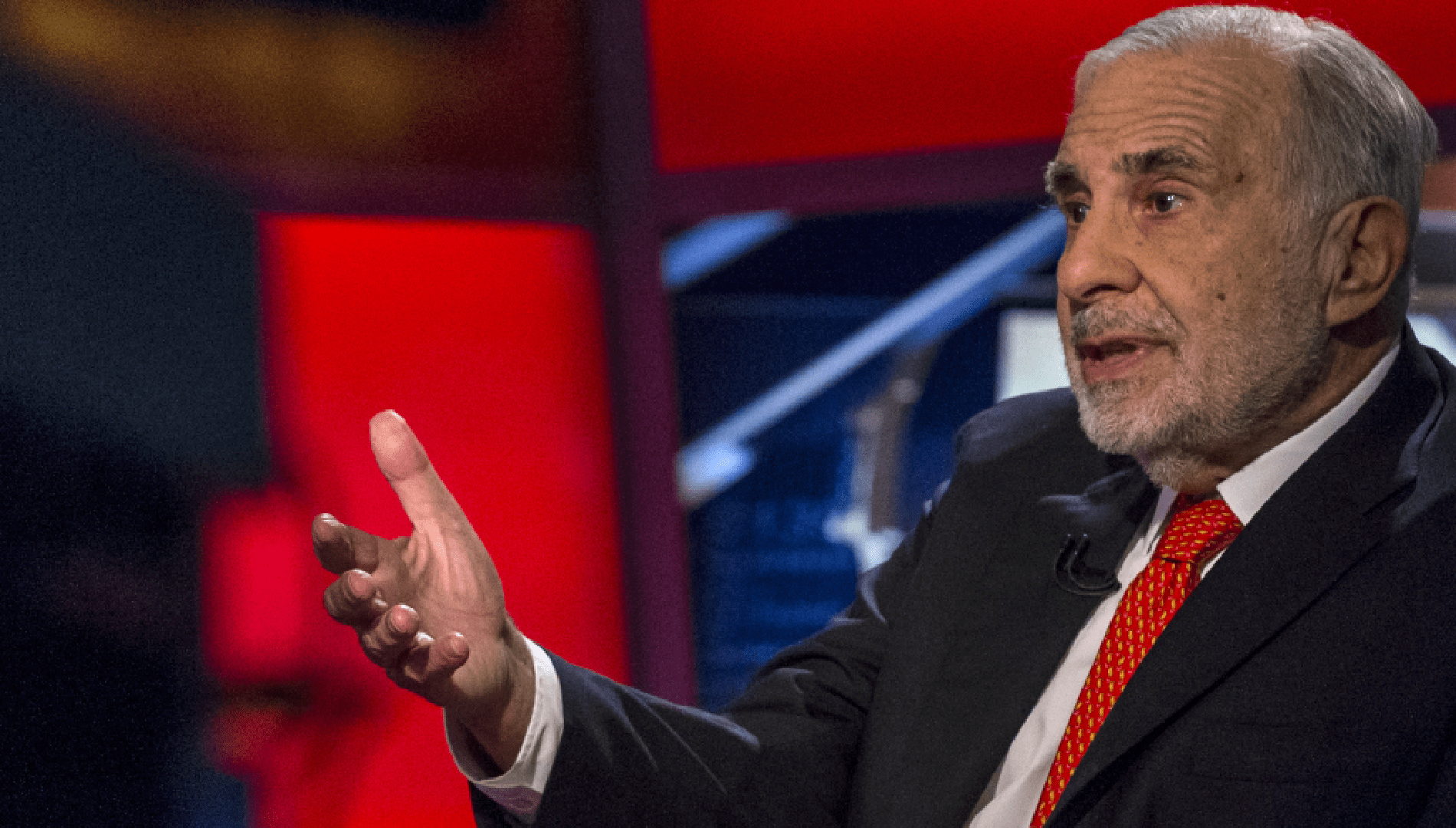

Thursday saw a spike in Caesars Entertainment (NASDAQ: CZR) shares after Carl Icahn's Icahn Enterprises (NASDAQ: IEP) said that it has begun a 2.44 million share holding in the operator of casinos.

According to a Form 13F filed with the Securities and Exchange Commission (SEC), Icahn specifically holds 2,440,109 shares of the gaming stock. Icahn's position in Caesars may have changed since the end of June, as large money managers and other professional investors are obligated to publicly report share stakes 45 days after the end of the previous quarter.

Icahn revealed to financial media outlets at the end of May that he had accumulated a "sizable" stake in the operator of Harrah's. What constitutes "sizable" depends on the viewer. Based on Finviz data, Caesars has 215.44 million outstanding shares. Icahn therefore has roughly 1.1% of the outstanding shares of the gaming company.

That places Icahn among the largest investors in Caesars by percentage, albeit outside the top 10. Combining to hold 18.67% of the shares, Vanguard and BlackRock are the two biggest shareholders.

Icahn states that he is not thinking of acting with Caesars

Ichan indicated he is a passive investor and, like everyone else in that group, he is hoping the gaming stock appreciates in value when he disclosed his Caesars position to CNBC in late May. He also stated he is not considering taking activist action with the gaming company.

Nevertheless, it is impossible to overlook his past with Caesars because he is largely responsible for the game's current state. Icahn Enterprises acquired about 10% of "old Caesars" in 2019, putting him in a position to later lead engineering for Eldorado Resorts' $17.3 billion acquisition, which gave rise to "new Caesars." Caesars is currently operated by Eldorado management, which includes CEO Tom Reeg. Reeg and the rest of Caesars' current management team are apparently highly respected by Icahn, which may have contributed to his decision to make a second investment in the company.

There is no doubt that market players are pleased that Icahn has taken back ownership of Caesars stock. In recent months, the day the financier confirmed the holding and today, when the investment size was disclosed, have seen two of the best intraday performances for the stock.

Consequently, unless Icahn Enterprises purchased Caesars a few days before May 31st, it is probably maintaining a negative position. The stock fell in April and May, and although it has recovered from its lows in late May, it still needs to reach the highs of the second quarter.

Potential Sparks for Caesars Stock

Even though Icahn Enterprises is probably losing money on Caesars right now, there might be events that spark interest in the shares.

These include the operator's digital segment becoming more profitable, the Federal Reserve cutting interest rates, and the continuous reduction of one of the biggest debt loads in the sector.

Reeg has consistently maintained that the firm would think about selling casinos that it considers to be "non-core" or that aren't making enough money.

Related articles

Check out some interesting and relevant articles on casinos.

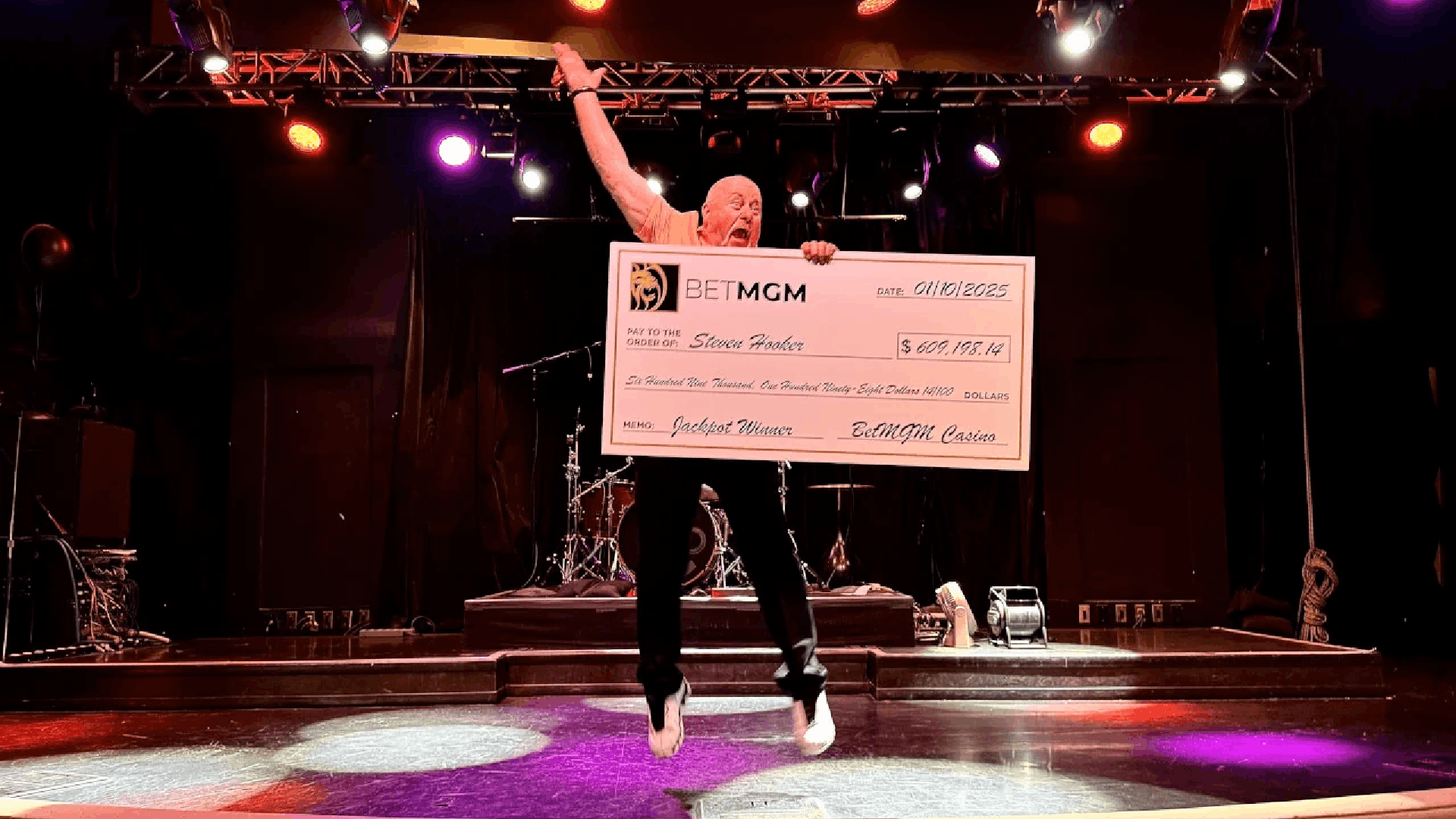

BetMGM Awards More Than $122 Million in Progressive Jackpots in 2025

Players at online casinos like the excitement of pursuing progressive jackpots because they know tha..

Caesars, DraftKings Seen as Winners as Maine Approves iGaming

In an early 2026 surprise, Maine this week became the eighth state to approve iGaming when Gov. Jane..

Chicago Budget Contains Sports Betting Tax, SBA Warns of Bettors Using Illegal Bookies

His proposed tax on sports wagers made within city limits is part of Chicago's $16.6 billion budget,..

United Kingdom

United Kingdom

Ireland

Ireland

Finland

Finland

Germany

Germany

Canada

Canada